A Perfect Storm: Indicators Positive for Long-Term Real Estate Investments

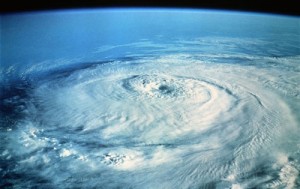

Do you remember that George Clooney movie called The Perfect Storm? It’s about a group of fishermen that get stuck in a horrendous hurricane. At one point during the film a group of characters talk about several smaller storms converging together right in the path of the fishing boat. Although that story ended tragically, there’s another storm on the horizon poised to create a different sort of deluge – profit.

Do you remember that George Clooney movie called The Perfect Storm? It’s about a group of fishermen that get stuck in a horrendous hurricane. At one point during the film a group of characters talk about several smaller storms converging together right in the path of the fishing boat. Although that story ended tragically, there’s another storm on the horizon poised to create a different sort of deluge – profit.

This past week CNBC announced a “return to normal†in the housing market. There are multiple indicators pointing to stabilization, if not recovery. These numbers are good news for housing as a whole, and incredible news for investors.

The current market condition has provided the opportunity to build real wealth through long-term Real Estate investments. Now is the time to buy rentals!

Just the Facts

Houses are selling. Last month the number of existing home sales jumped 8% from July and 9% from August on 2011. Builders broke ground on more residential projects last month than they have in years. The current inventory of listed homes is hovering around the 6 month mark (this is traditionally accepted as equilibrium in supply and demand).

Prices are increasing. For the second consecutive month, the median home sales

price went up. In August the number rose 9.5% to $187,400. Looking over the horizon, the market bottom is behind us.

Rental rates are up. According to CNN Money, rental rates in June were up 5.4% over the prior year. This fact has been fueled by uncertainty in the economy as well as an increased number of unqualified borrowers. Regardless of the fact that it’s 45% cheaper to buy a house in the top 100 metropolitan areas than it is to rent, there’s a huge tenant demand.

Interest rates are ridiculously low. At the time of this article, advertised mortgage rates are as low as 2.75%. The Federal Reserve’s most recent round of quantitative easing is likely to keep rates down for the foreseeable future.

Profit in the Numbers

So how does all this play into your investment strategy?

The increases, both in the number and median price of housing, indicate a stabilization of the market. We are unlikely to see skyrocketing values any time soon. But we also seem to be out of the tumultuous times when properties were losing value by the minute. For the long term, stable is good.

Although home prices are on the increase, there are still deals to be had. The large number of bank owned properties and motivated sellers provides opportunity to pick up properties well below market value. When prices go up, and they will, big profits will result.

In the short term, the high rent rates and low interest rates offer immediate cash flow.

Now is the time to capitalize on the current housing market. All the factors are pointing to long-term Real Estate investments as the opportunity for incredible profits. If you’ve been stuck on the deck, it’s time to shrug off your uncertainty and get wet.

Write a Comment